Governor of the Bank of Ghana, Johnson Pandit Asiama, has declared that Ghana’s banking sector has moved beyond stability and must now focus on building long-term durability.

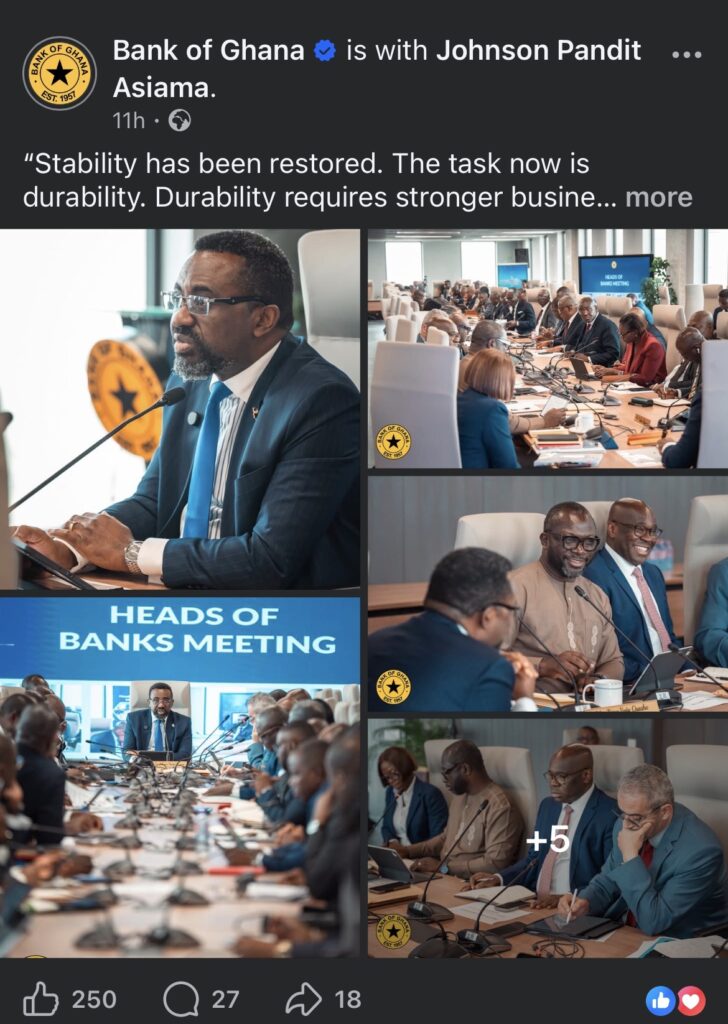

Speaking at the bi-monthly meeting of heads of banks on Wednesday, 18 February 2026, Dr. Asiama emphasized that while the financial sector has regained stability, sustaining that progress will require deeper structural reforms and stronger governance.

“Stability has been restored. The task now is durability,” he stated in his opening remarks. “Durability requires stronger business models, broader ownership, deeper intermediation, disciplined innovation, and sound governance. The Bank of Ghana will continue to engage as a firm, fair, and forward-looking partner, supportive where necessary, but clear in its expectations.”

Touching on the January decision of the Monetary Policy Committee (MPC), the Governor explained that the Committee met at a time when both global and domestic economic conditions were showing signs of improvement.

Dr. Asiama noted that inflation had declined faster than expected and inflation expectations remained well anchored. “With inflation declining faster than anticipated and expectations well anchored, the Committee judged that monetary conditions remained sufficiently tight relative to prevailing inflation dynamics,” he said.

As a result, the MPC, by majority decision, reduced the Monetary Policy Rate by 250 basis points to 15.50 percent. The move signals cautious confidence in the disinflation process while maintaining a tight monetary stance to safeguard macroeconomic stability.

The Governor also disclosed that the central bank undertook a thematic review of banks’ operations last year. According to him, the review focused on assessing business models, examining funding structures, and evaluating governance effectiveness across the industry.

Beyond regulatory oversight, Dr. Asiama highlighted emerging priorities for the banking sector, including strengthening cyber security systems and encouraging banks to raise capital through listings on the Ghana Exchange Stock

His remarks signal a clear direction for Ghana’s financial sector one that moves beyond short-term recovery toward building resilient, well-governed institutions capable of supporting sustained economic growth.