Ghana’s ability to maintain stability of the cedi after exiting its International Monetary Fund (IMF) programme will depend heavily on fiscal discipline, strong external buffers and credible policy direction, according to Dr Theo Acheampong, Technical Advisor at the Ministry of Finance.

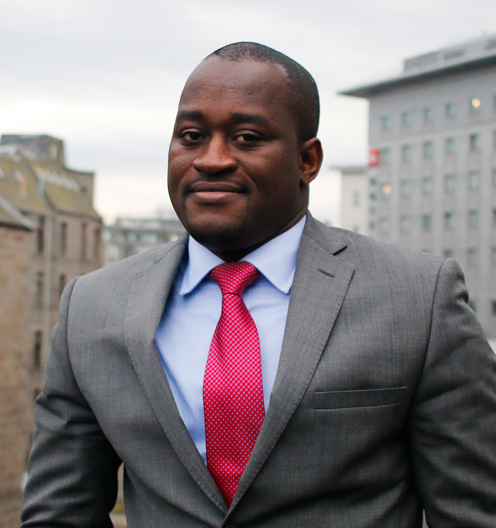

Speaking during an X Space discussion organised by NorvanReports and the Economic Governance Platform (EGP) on the theme “Cedi Stability in 2026: Can Ghana Hold the Line After the IMF?”, Dr Acheampong stressed that predictable macroeconomic conditions are essential for both economic planning and investor confidence.

“Everybody wants to plan on the basis of stability. Once expectations are stable, planning becomes one less hurdle,” he said, referencing the significant appreciation of the cedi from May 2025 through the latter part of the year against major international currencies.

Dr Acheampong attributed much of the cedi’s recent strength to developments in the external sector, particularly Ghana’s commodity exports. Although Ghana is now a net exporter, export earnings remain largely concentrated in three commodities: gold, cocoa and oil.

Citing Bank of Ghana data, he noted that as of December 2025, Ghana’s total exports stood at approximately US$31 billion, with gold alone contributing around US$21 billion. During the same period, imports amounted to US$17.5 billion.

“In effect, gold exports alone are able to cover most of Ghana’s import bill,” he explained. This, he said, has been a critical stabilising factor for the country’s balance of payments, current account position and foreign exchange reserves.

Beyond favourable external conditions, Dr Acheampong emphasised that domestic fiscal discipline will ultimately determine whether Ghana can sustain currency stability after leaving the IMF programme.

He highlighted recent amendments to the Public Financial Management (PFM) Act, which introduced two binding fiscal rules: a public debt ceiling and a primary balance rule. Under the revised framework, public debt is expected to decline to 45 percent of GDP by 2034, while government must maintain a primary surplus of at least 1.5 percent on a commitment basis.

Provisional figures for 2025, he said, show Ghana’s debt-to-GDP ratio hovering around 46–47 percent, bringing the country close to its medium-term target.

“The key issue going forward is how we live within our means,” he stated, adding that early signs point to continued compliance with the primary surplus rule into 2026.

Dr Acheampong also pointed to the increasing importance of institutional oversight in a post-IMF environment. He noted that the Fiscal Council will play a central role in monitoring adherence to the new fiscal rules.

In addition, the Ministry of Finance has established a dedicated compliance division to enforce PFM reforms and strengthen commitment controls. This, he explained, is aimed at preventing the build-up of arrears and avoiding expenditure overruns.

“As we exit the Fund programme, enforcement of the amended PFM regime becomes even more critical,” he said.

On the monetary front, he stressed the importance of continued reserve accumulation by the Bank of Ghana, noting that maintaining at least three months of import cover remains a key policy anchor. He added that favourable global gold prices, as indicated in IMF analysis, could further strengthen Ghana’s reserves if managed prudently.

Summing up, Dr Acheampong outlined four core pillars necessary for sustaining cedi stability in 2026 and beyond: favourable external conditions, particularly strong gold prices; strict control of public spending; effective prevention of arrears; and alignment of the medium-term debt strategy with fiscal rules.

“Fundamentally, it’s about sending credible signals to the market,” he said. “From where I sit, the markets are interpreting those signals correctly, and I don’t see any reason why we should not be able to sustain the performance we saw in 2025.”