ACDT Calls for Collaboration to Enable Ghana Card as ATM Card

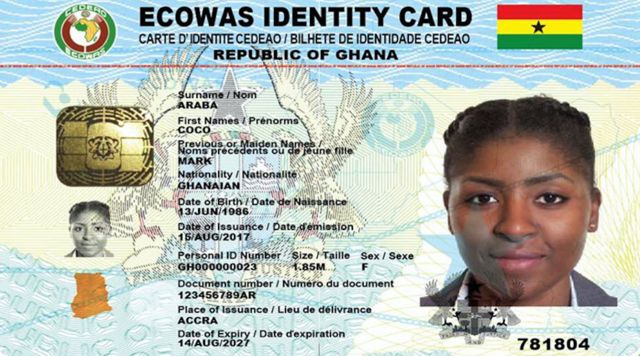

The Africa Centre for Digital Transformation (ACDT) has urged the National Identification Authority (NIA), the Bank of Ghana, and financial institutions to work together to ensure that the Ghana Card can function as an ATM card for banking transactions.

In a press statement issued yesterday, ACDT stressed the importance of integrating the Ghana Card into the country’s financial system, a process that was initiated under the previous administration. The organization believes this step will improve financial inclusion, enhance security, and provide greater convenience for Ghanaians.

To support this transition, ACDT proposed key measures, including:

- Seamless Bank Integration: Ensuring that all bank accounts are securely linked to the Ghana Card, allowing users to withdraw cash, make transfers, and complete payments with ease.

- Enhanced Security Measures: Strengthening transaction security by incorporating biometric authentication, such as fingerprint verification, alongside PIN protection.

- System Upgrades: Encouraging banks and businesses to upgrade their ATMs and Point-of-Sale (POS) terminals to accept Ghana Card transactions.

- Regulatory Framework: Establishing strong legal and cybersecurity measures to safeguard users against fraud and unauthorized access.

- Public Education: Launching nationwide awareness campaigns to guide citizens on how to link their Ghana Cards to their bank accounts and use them safely for transactions.

ACDT believes that implementing these measures successfully will mark a major step forward in Ghana’s digital transformation, making financial services more accessible to all citizens.

The organization called on all stakeholders to take swift action in making this vision a reality.